Articles

Dvds generally never come with monthly charges and therefore are federally covered so that your money is protected, which makes them one of several trusted offers vehicle. LendingClub also provides Computer game terms between 6 months in order to 5 years and you will earn around 4.00% APY. You will find an excellent $2,five-hundred lowest necessary to open a great Computer game membership and put to $250,one hundred thousand. Once readiness, in case your Video game goes more than, you will secure the new provided interest rate for your Computer game type in impact during the time. A premier-produce bank account is a good choice for whoever desires to earn an aggressive produce on their savings account to improve its offers potential. Bask Lender is acknowledged for its highest-yielding Bask Interest Bank account.

He contributes you to definitely Juno will even provide unique around three-rooms products with lock-from rooms — a good about three-bedroom equipment which is often partioned into a two-bedroom unit and you may a facility unit — that will begin at just more $1M. Traders can be unlock a fixed Put with Mahindra Finance to help you a keen funding restrict all the way to ₹twenty five crores. The fresh data you’ll need for seniors are the same as it is actually for most other regular buyers. The brand new documents may differ only when you want to discover an enthusiastic FD membership because the a buddies, corporation, bar, connection, charitable faith, etc. You can refer to the newest files necessary area to locate a complete listing of data files expected.

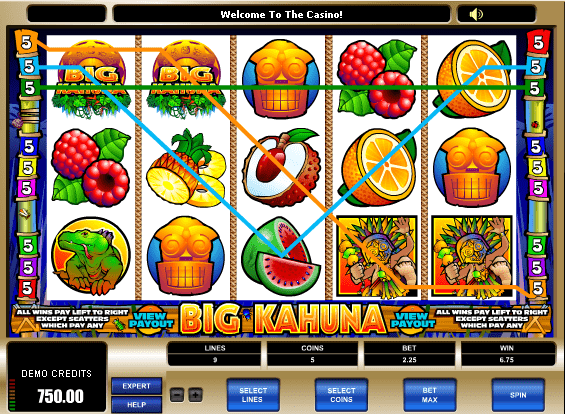

In reality, of Bankrate profiles mr bet 5 percent cash back nz , 42 %, otherwise almost 270,000 users, intend to put down lower than 20% for their down payment, based on Bankrate’s 2023 Yearly Analysis declaration. The stock exchange is actually unstable for small-term deals, very until your target date for selecting a home try means later — state, ten years or more — it’s wise to go after a more steady alternative rather. You to really serious business downturn can also be set you back notably, not to mention discourage your own lingering perform.

Now, allow your currency keep working harder to you by allowing they grow inside an appeal-affect membership. To compare choices, look at an account’s annual percentage yield (APY). It shows the amount of desire you’d earn on your bank account equilibrium more one year. The fresh function is frequently free and you may automated with particular eligible put membership.

The fresh LTV (in cases like this 90% LTV) ‘s the number you obtain compared to property value the newest possessions. Very first prices are the thing that you have to pay within the introductory bargain period (otherwise repaired-price months – in this case a few or five years). As the 95% financial make sure strategy is always to suggest a boost in the number of 5% put finance readily available, you’ll still need to solution financial’s rigid value testing discover their home loan. Luckily, underneath the 95% home loan ensure system, loan providers have to give at least one four-season repaired speed tool to help you people. The bank out of England’s ft rate of interest remains at the a record low of 0.1% during writing, definition borrowing from the bank is never less expensive for those seeking purchase a home.

Once your Cd matures, Quontic Financial provides a ten-time elegance several months so you can withdraw the finance. You can use Bankrate’s home loan advance payment calculator to find a sense of how additional down payment amounts impact your own monthly mortgage payment, as well as the desire you’ll save by putting additional money down. You might have read you’re necessary to put down 20% for the a property. Just how much to put down on a home relies on the fresh form of financing you get plus the mortgage lender’s standards, among other factors. Banks generally understand ahead if your checking account will get an immediate deposit.

Really mortgage lenders will simply give a mortgage to your another home when you can render a good 20% – 25% deposit. When you can get a 10% deposit financial for an extra home, you will have the standard high rates to own a 90% home loan and you may deal with more strict standards. A household counterbalance mortgage lets parents fool around with the their discounts and/or security in their home to help their child put in initial deposit to the a property. The fresh offers is attached to the debtor’s loan, decreasing the loan amount on what attention is paid. If equity is utilized, the lending company leaves a fee on the father or mother’s property.

If you would like get the newest price, we strongly recommend your spend money on a new repaired put with us. FD money calculator is an excellent online equipment enabling you in order to determine the fresh maturity matter as well as the attention gained. Understanding the direct readiness number ahead makes you generate a keen told using decision and produces your financial believed simple. Shield your future that have Mahindra Financing Fixed Deposits – India’s top financing options.